GST Autoleather explained yesterday how it ended up with 200 million USD of debt: downturn of the market and impacts that services such as Uber have had on the industry. Yet, according to news coming from the Unites States, there seem to be other reasons why the US-based group is on the verge of bankruptcy. “The margins for gain got slimmer, and many missteps were taken”, says a newspaper out of Detroit. There are, apparently, two main obstacles GST encountered. In the period going from April 2016 and summer of 2017, 20% of materials were apparently rejected by a European producer: one of its supplier hasn’t passed the verification standards of its client, which caused a total damage worth 8 million USD to the company. An even more challenging situation is the one at the end of 2015, when a Chinese tannery started asking for higher prices on its products than those negotiated at the beginning. The search for a new supplier and the cost of building a new site in China costed GST extra expenses for 24 million USD. On the other hand, research by Markets and Markets claims that by 2021 the entire business of material and interiors for the auto industry will be worth 98.7 billion USD, considering an expected yearly growth of 11.8%.

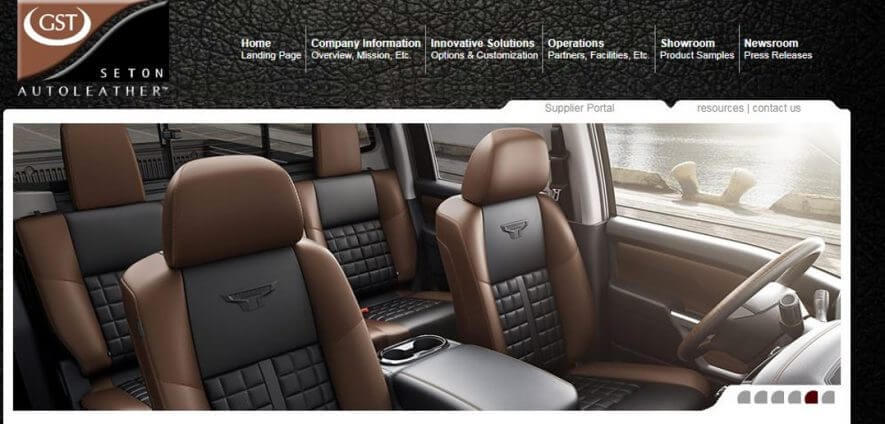

20% of leathers denied and a new Chinese supplier to be found: all the holes in GST’s operations