Gucci’s revenues will supposedly reach, at the end of 2019, 9.5 billion euros, therefore increasing by 12% on annual basis. What is going to happen then? According to Goldman Sachs forecast, the turnover of Kering group’s core brand will keep growing to reach, from 2020 until 2023, a 9% increase on annual basis. Quite a rewarding accomplishment indeed. Yet, looking at the report issued by the financial bank, reported by Milano Finanza, we assume that Gucci mega-boom, which drove a remarkable 30% growth, on annual basis, from 2015 until 2018, is bound to be over. In other words, the fashion brand, led by Alessandro Michele and Marco Bizzarri, is going to experience a “normalization” phase.

Stock Exchange ploys

Goldman Sachs financial analysts do not consider such trend to be a weak point for the brand. Although Italy’s Inland Revenue might be soon opening a new investigation into the fashion house, the Gucci factor is still drawing investors, who are willing to “buy” Kering stocks anyway. While talking about the French holding corporation, they have just issued a number of 500-million-euro bonds: the aim is to swap them with some Puma shares, which will be due in 2022. Such transaction may enable Kering, which is in control over 15.7% of the German sport brand, to sell 3.5% of its stocks, while playing to focus energies and assets on luxury activity.

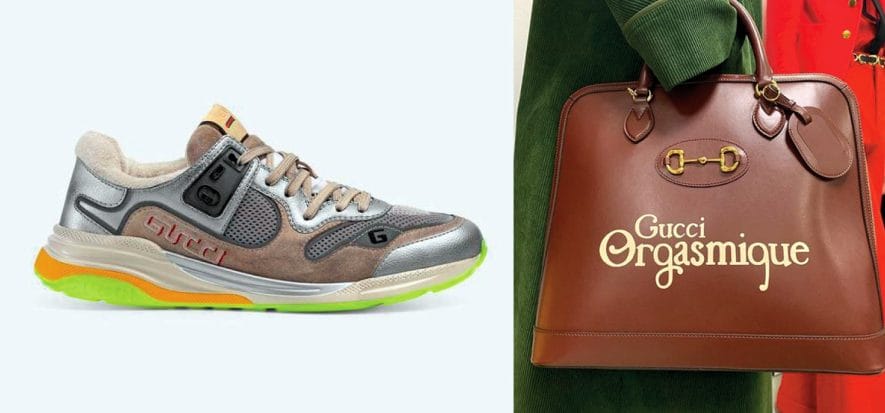

Pictures taken from Gucci.com and Alessandro Michele’s Instagram account