They are not planning to buy out Versace nor Moncler. While illustrating Kering’s prospective strategies, François-Henri Pinault made clear they are going to enhance, most of all, the portfolio of brands currently controlled by the group. They might even opt for new acquisitions, though choice standards are supposed to be extremely strict.

They will not buy out Versace nor Moncler

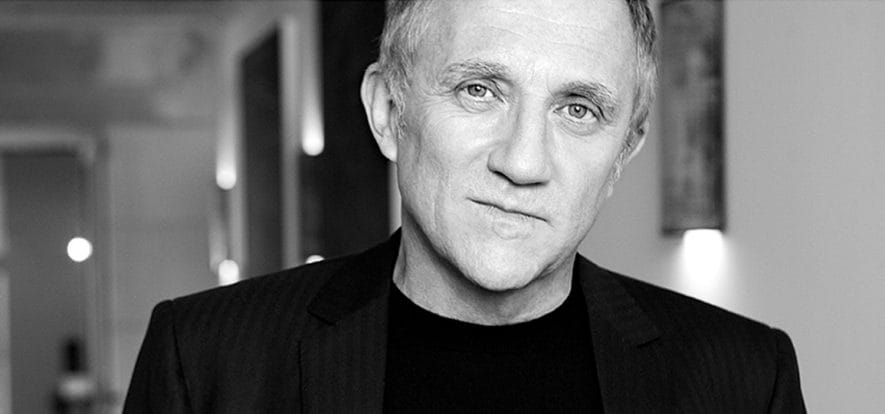

While analysing 2019 turnover, Pinault, president and chief executive officer of Kering, illustrated, before some journalists, a few present topics alongside his prospective outlooks. The most topical issue was the one about acquisitions. As reported by WWD, Pinault announced he gave up on Versace in 2018 because the buyout price, 2.1 billion US dollars, was far too high. “We were not that interested in the brand and we gave up on trying to acquire it because of the price”, pointed out the entrepreneur. Likewise, he also denied the group’s interest in the acquisition of Moncler. “We are not negotiating at all. We know each other, and we highly regard each other”, said Pinault, therefore shedding light on his heavily publicised encounters with Remo Ruffini: we were not talking about any merger deal, as we were rather discussing the Fashion Pact.

A few potential acquisitions

In the French company, a team of employees examine potential and feasible acquisitions. “We keep monitoring and considering valuable business opportunities that might pop up in the market. We do not have a passive attitude, though we are very selective a great deal anyway”, remarked Pinault. While interpreting his statements, we may factor out, then, some of the group’s possible targets: their main competitors, alongside small-sized companies and watch manufacturers.

Gucci addicted

Some investors wish Kering would not be Gucci addicted to such great extent. Pinault replied by saying that, in his opinion, “there is not any balance problem”. Moreover, the Florentine brand successfully created a virtuous circle from which the other brands of the group may well benefit. “Gucci is our backbone: they still have a great potential and will keep playing better, in terms of performance, than the other luxury brands”, said Pinault while speaking to La Repubblica.

Their own brands

While talking about the group’s own brands, Kering chief executive officer also emphasized, during the same interview, Saint Laurent’s primary goal, that is, to augment its revenues from 2 up to 3 billion euros, therefore focusing on apparel and footwear: at present, leather goods drive 70% of the brand’s overall turnover. As regards Bottega Veneta, the plan is to get soon back to a growth in double figures, while Balenciaga, in which they have carried out a few investments, soundly exceeded one billion euros, in terms of revenues, last year.

Chinese matters

As regards Coronavirus outbreak emergency, Pinault pointed out: “All of our brands are always ready to implement a backup plan: in fact, they promptly did it in China”. As for production, Pinault announced they decided to slow down seasonal manufacturing, which mostly takes place in Italy. Furthermore, they have been directing somewhere else products formerly sold on China’s market.

Read also: