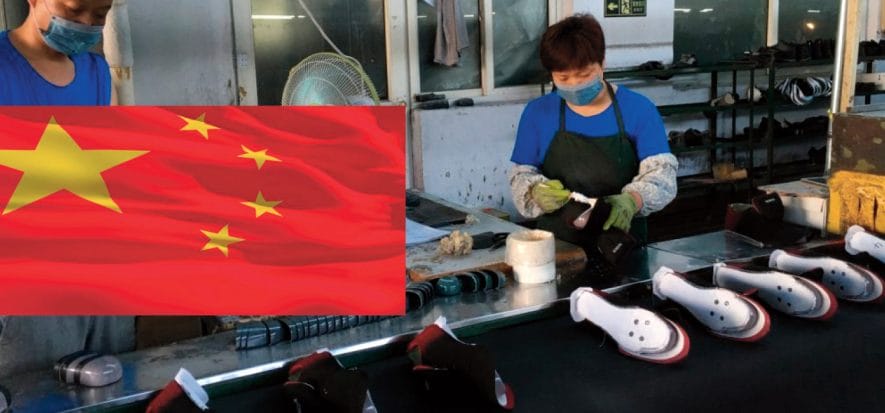

It is progressively turning more resilient and closer to customers. In other words, it is getting more expensive. Therefore the supply chain is changing, in a scenario that proves rewarding to Vietnam, India and Mexico, not to China though. Such are the results of a survey carried out by Gartner (a company that specializes in strategic consultancy projects) in February and March. They targeted 260 supervisors of the whole of global supply chain. This is the moral of the story: goodbye China (to some extent).

Goodbye China

One third of interviewees have already relocated their supply and/or production out of China. Likewise, they are planning to do it within two or three years at the latest. “Formerly in 2018 and in 2019, the trade war between the United States and China highlighted how weak global supply chains are.

While dealing with interdependent, concentrated and deeply outsourced production networks, new needs have arisen”. In other words, they have been paying “more attention to network resilience alongside the possibility to implement a closer production, that is, a more local one”. Businesses, then, are on the way to say “Goodbye China” shortly.

A price to pay though

“Such change entails some fees though”, summarized Kamala Raman, senior director analyst at Gartner, on FDRA portal (the association of distributors and retailers of America). “What do we mean by resilience? Most of all, it is the ability to relocate swiftly supply, production and distribution whenever a disruption arises. Yet, investing in resilience requires assets – pointed out Raman –. That is why top brands might be compelled to support their strategic suppliers, while looking for some alternative options over the current period”.

Why moving away from China?

The survey, carried out by Gartner, evidenced that several companies are willing to relocate their supply chain out of China. Their decision mostly depends on the increase in prices, which consequently caused logistic expenses to rise by over 40%. “Alternative countries are Vietnam, India and Mexico”. “One more reason why they are planning to leave China is the necessity to make provision networks more resilient”, remarked Raman. That entails rising costs though. Such is the opinion of 58% of interviewees.

Closer to demand

One quarter of interviewees confessed they have already “regionalised or delocalised production” in order to get closer to clients’ demand. “Several western manufacturing enterprises will have to explore new automation models, in their own factories, to reduce costs related to close or inshore production. Some of them are also in favour of combining, for example, production in Asia and relocation of final assembly only somewhere closer to customers”, wrapped up Raman.

Read also:

- The appeal is working: some are starting to move production from China to India

- Reshoring for Church’s: less in Italy, more production in the UK