LVMH offers 14.5 billion USD to buy Tiffany. If the sale was to be approved, it would be the largest acquisition in the history of the French conglomerate. On the other hand, as for now, rumors say that an American dismissal of the proposal is “very likely”. The reason? The offer is too low: “Arnault undervalues us”, is the alleged answer from Tiffany.

Leadership in jewelry

Breaking the news of the French offer was the Wall Street Journal. LVMH later confirmed the indiscretion and is aiming at trying to bring Tiffany inside the group with an offer of 120 USD per share, more than 22% the value-per-share at which Tiffany closed on Friday, October 25th (98.55 USD). The proposed acquisition would allow LVMH to gain full leadership in the jewelry segment, thanks also to the other two top-performers it owns, Cartier and Bvulgari. “LVMH has the disposable liquidity to reach an agreement. We also foresee many synergies under a strategic a financial viewpoint”, write Cowen’s analysts in a note.

Tiffany and Bogliolo

The US-based company closed its last fiscal year with 4.442 billion USD. 7% of it is generated through the sale of leather goods: over 300 million USD. Not peanuts, one may say. The brand has 300 retail stores around the globe and is led by Alessandro Bogliolo, a name that is well known to Bernard Arnault. Mr. Bogliolo worked for Bvulgari for 16 years and also covered the role of North America Director for Sephora, another brand owned by LVMH (source: IlSole24Ore).

The strategy

Bogliolo has drastically improved Tiffany’s financials, although they remain only somewhat healthy. The competition within the accessible-luxury segment is weighing down on the brand’s performances. An aspect that makes LVMH’s offer particularly interesting for analysts. Interesting, yet risky, due to the potential internal overlap of the brands owned by the French group. According to Jefferies, “Tiffany is, potentially, the main prey and only international brand in the US-based luxury segment”. After opening Vuitton’s production site in Texas, Arnault seems to be taking an additional step towards its American campaign.

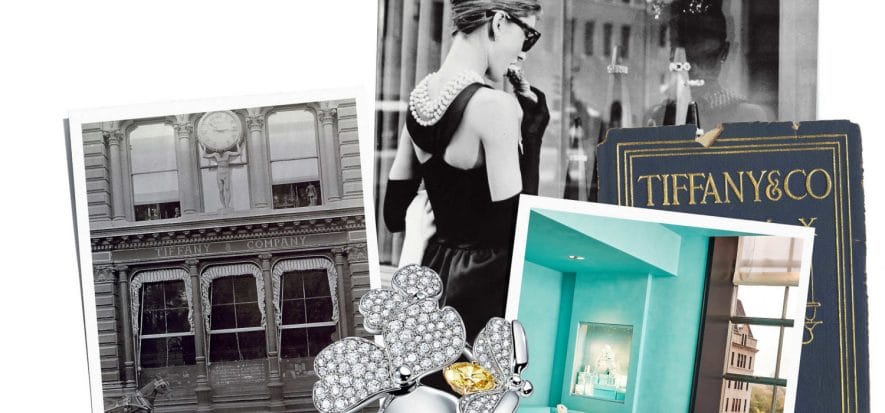

Image from Tiffany website

Read also:

The Trade War worries Ferragamo. Acquisitions? “Our priority is different”