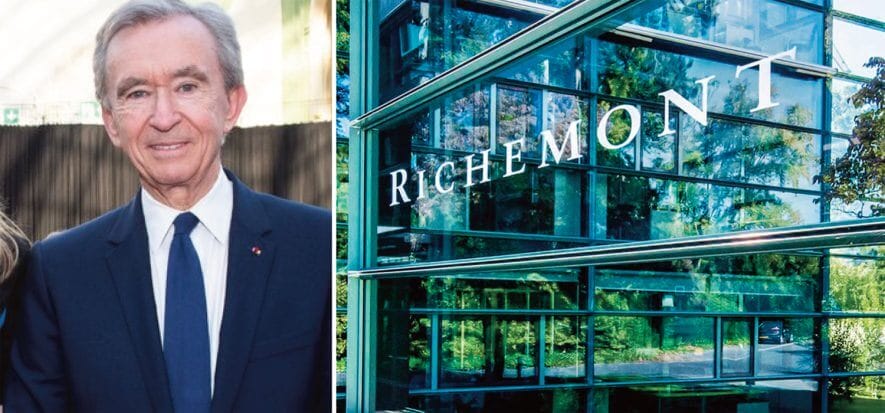

LVMH may not acquire Richemont or Cartier. But it will surely buy back its shares from the market. The group’s leader, Bernard Arnault, is betting that the price of LVMH’s shares will increase. The luxury giant at the center of “Swiss” rumors saying that it wishes to buy Cartier or even the entire group that owns it: Richemont. Analysts remain skeptic however, and explain why. What we do know is that the French conglomerate will, by July 20th, enact a buyback worth at least a billion.

Not going to happen

According to Swiss news source Finanz und Wirtschaft, LVMH is allegedly looking to buy Cartier away from Richemont. But Johann Rupert, the leader of the multinational, is opposing it, just like when he opposed Kering’s interest. The market also believes it unlikely that the sale will be actualized. LVMH doesn’t lack jewelry brands after having purchased Tiffany. Thus, there are no apparent reasons leading operators to believe that Richemont is interested in selling its top brand.

Years of rumors

“For years rumors over a potential merger between Kering and Richemont were heard. Now it’s LVMH’s turn to enter the mix. It’s a rumor that is cyclically brought forward, but I don’t expect it concretize in the short term”, summarizes Carole Madjo of Barclays to Milano Finanza. Luca Solca, of Bernstein, pointed out issues with anti-trust authorities: “The greatest challenge to the acquisition is the obtainment of approval from antitrust authorities in markets where this operation would be evaluated on the terms of market share per specific price segment. In China, for example”.

A buyback worth a billion

For the moment, all we know is that Bernard Arnault (on the left in the photo from Imagoeconomica), patron of LVMH, believes the value of its group’s shares to grow in the future. That’s why LVMH states it plans on starting a buyback process for a value of 1.5 billion euro. The process will end on July 20th. “Re-acquired shares will eventually be nulled”, said the group on an official statement.

Read also: