Kering will pay 1.7 billion euros and take 30% of Valentino. The deal includes an option to take the 100% stake in the Mayhoola-controlled fashion house by 2028. This is the market move of François-Henri Pinault, CEO of Kering, who has been on the hunt for a prey ever since rival LVMH took over jeweller Tiffany. As the proposal made to Richemont have been rejected, Pinault has found a valid alternative. Indeed, a very good one: an agreement with Mayhoola, owner of Valentino. Kering gave the news at the same time as it announced its half-year figures. Overall sales were up narrowly, while Gucci‘s were still reflective. This puts the French giant in a difficult position compared to its competitors.

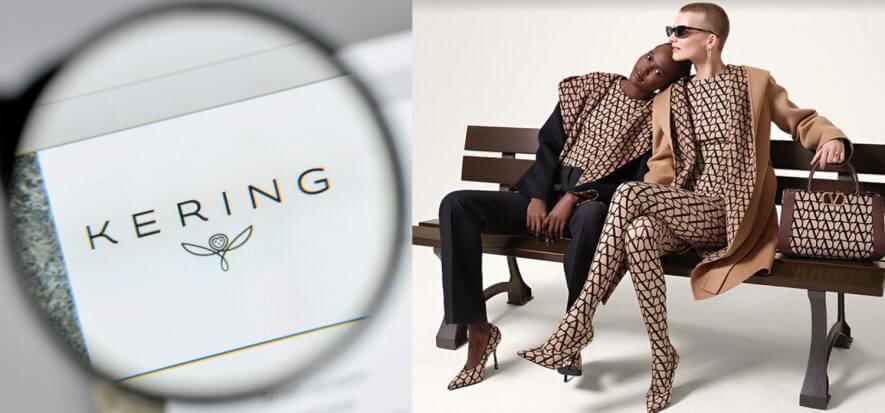

Kering takes 30% of Valentino

“This transaction is part of a broader strategic partnership between Kering and Mayhoola, which could lead to Mayhoola becoming one of Kering’s shareholders”, reads the note released along with the half-year figures. The designer brand controlled by the Qatari fund reported sales of 1.4 billion euros in 2022, with an EBITDA of 350 million euros. The transaction is expected to be concluded by the end of 2023, subject to approval by the relevant competition authorities. “I am very pleased that Mayhoola has chosen Kering as a partner for the development of Valentino. I am very pleased with this first step in our collaboration with Mayhoola for the development of the brand”, is Pinault’s comment.

Gucci struggles again

On the half-year figures front, Kering said that revenues increased by 2% to 10.14 billion euros. At current exchange rates, Gucci lost 1% of revenues, Saint Laurent gained 6% while Bottega Veneta remained stable. The group’s net profit fell by 10% compared to the same period last year.

Read also: