German retail apocalypse? Local experts believe it to be an exaggeration, and even if insolvency of retail chain have effectively tripled in 2023 (compared to 2022), the situation is more of a shift than a deep crisis. The situation may not be so negative, if one knows how to capitalize on the opportunities this shift is bringing to the market.

German retail apocalypse?

Insolvency among retail chains specialized in fashion (and capable of generating over 10 million euro per year) have tripled compared to 2022. From 11 to 33, according to German consultancy firm FalkenSteg. If we consider all fashion companies, regardless of revenue, 160 insolvency cases were tracked: +57% on 2022. GFK (largest market research firm in Germany) stated that local consumers are concerned with inflation and willing to spend less, but save more. Should we expect additional cases?

More than a crisis, it’s a shift

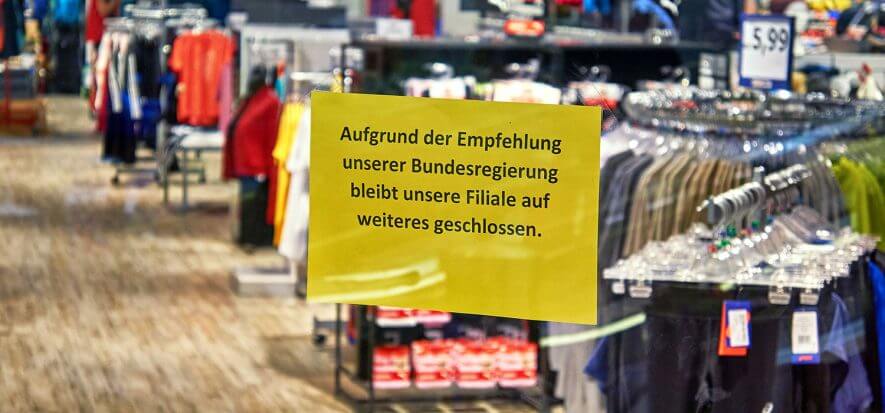

The answer, according to experts, is no. “It’s been a bit exaggerated”, says university professor Jochen Strähle: “We are at a turning point for the sector”. Simply put, analysts interviewed by WWD agree when saying the German retail chain isn’t in crisis: it’s simply changing. It should have happened a few years ago, but unprofitable businesses were supported by government help during the pandemic.

The reasons behind insolvencies

Leo Faltmann, director of FashionConsult, listed the reasons behind the growing cases of insolvencies. First: Germany has too much commercial spaces in city centers. Second: the growth of online sales currently make up 40% of total sales of fashion and accessories. Third: the market is very competitive and shows a flat trend. A company wishing to increase in size needs to do by taking market shares from others. Fourth: the main struggle is for mid-end companies, as many of them are insolvent.

Opportunities

McKinsey analyst Achim Berg believes that trends such as casualization and solidity of sneakers represent a growth opportunity. Those incapable of taking them up are leaving the marketplace. “But this has created space for new players”, concludes Berg.

Read also: