The foreseen and disruptive growth of Australia-based brand RM Williams could attract buyers such as VF Corp. Or, finance giants such as Fosun or Lunar Capital, just as well as Australian investors. Investment bank Goldman Sachs has, in fact, opened up the sale of the brand owned by L Catterton (created in 2016 from the partnership with Groupe Arnault, LVMH and US-based fund Catterton). In order to tempt potential buyers, the bank has made available the brand’s financial forecasts from here till 2024. RM William’s outlook is more than positive, as the brand famous for its Chelsea leather boots is expected, within the next 5 years, to go from gross profits of 23 million USD to 83 million.

The detailed forecast

Goldman Sachs has sent an informational packet to the interested buyers (obtained by Street Talk). In this packet one may read that the brand closed its last fiscal year with gross profits of 23 million USD (before interests, taxes, and depreciation). Additionally, the documents show the forecasted growth of the brand: 34 million in 2021; 83 million USD in 2024.

12 consecutive quarters

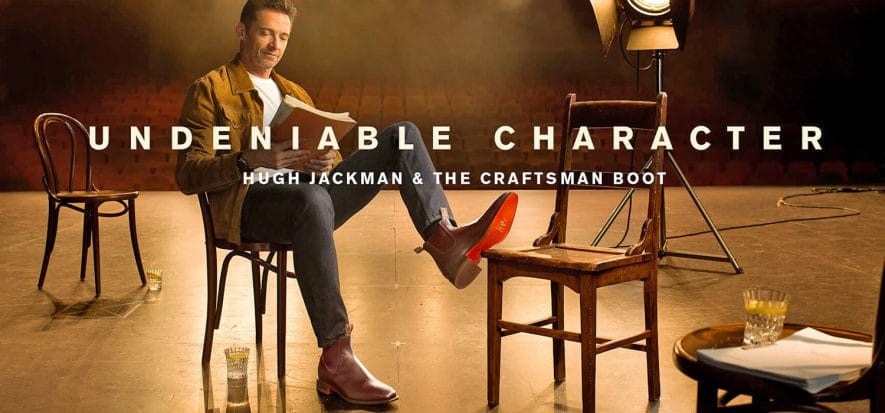

Moreover, Goldman Sachs has communicated to interested parties that RM Williams has had 12 consecutive quarters of sales’ growth in the comparable stores located in Australia and New Zealand. Revenue grew by 10% annually, on average, during the last 4 fiscal years. 82% of the brand’s capital is owned by L Catterton (which began with minority shares), while the remaining 18% is held by actor and film director Hugh Jackman (5%) and IFM Investors (13%).